Personal Bankruptcy

Personal Bankruptcy – Relief From Debt and a Fresh Financial Start

Bankruptcy. Something you never thought you’d be researching. If the thought is unpleasant, think about this: in 2015, nearly 40,000 people filed a bankruptcy or consumer proposal in Ontario; of those, approximately 17,000 live in the Greater Toronto Area. In all likelihood, you probably know many people who are or were bankrupt at some point (not surprisingly, most people don’t speak openly about it).

To most people, bankruptcy is filled with misconception. There are misconceptions about losing assets, about paying huge amounts to a trustee, about the amount of time a bankruptcy will take, and about powers of your creditors after you file.

Bankruptcy Explained

Bankruptcy is a legal process that provides relief to people with unmanageable debt. The idea is to allow honest but unfortunate people the opportunity to eliminate their debt and emerge with a clean slate – a fresh financial start.

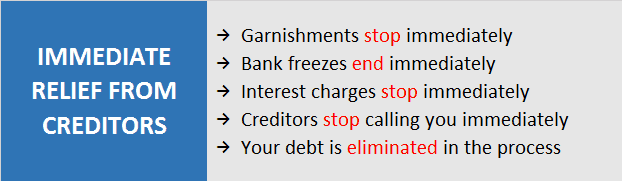

Bankruptcy Means Relief From Creditors

When you file a bankruptcy in Ontario, relief comes in many forms. You’ll benefit from an immediate end to all action taken by your creditors. Wage garnishments, bank freezes, legal proceedings, interest charges and creditor telephone calls in respect of the debt all stop once you file a bankruptcy. You’ll also benefit from the complete elimination of your dischargeable debt upon the successful completion of your bankruptcy. Most if not all of your debt will be eliminated in the process. The point of the process is to allow you to re-start your financial life free of the stress, pressure and strain caused by debt.

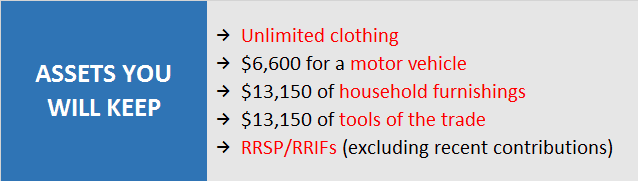

Bankruptcy Means a Reasonable Standard of Living

The bankruptcy system is set up to allow people to maintain a reasonable standard of living while they go through the process. The idea is not to take everything you own and put you out on the street. In fact, you may keep many of the assets that you hold dear. For example, in Ontario you will keep a car valued at less than $6,600, you will keep all necessary clothing, and you will keep household furnishings and appliances valued at less than $13,150. You will even keep all RRSP contributions made more than one year before your bankruptcy.

Bankruptcy Means Getting Out of Bankruptcy

Sound odd? If it does, understand that the bankruptcy system is not set up to keep you in it indefinitely. In fact, many people get out of bankruptcy in just 9 months. The length of your bankruptcy will depend on a number of factors including your income and the number of prior bankruptcies you’ve had.

Five Steps to Debt Freedom

- Call us today at 416-800-8756. Give us some information about your situation, and we’ll diagnose your situation over the phone

- Meet with our federally-licensed professionals to sign the paperwork

- We file the paperwork with the federal government and send a copy to your creditors, putting an end to garnishments, harassment, legal proceedings and interest charges

- We administer your bankruptcy, settle non-exempt assets, collect payments (if required) and act as a liaison between you and your creditors

- Upon successful completion, your dischargeable debt is eliminated – there is no legal requirement to pay the debt in the future

Ross Advisory Group

The federally-licensed professionals at Ross Advisory Group do much more than simply prepare and file your bankruptcy paperwork. We guide you through the entire process by explaining in advance what you can expect at each stage and then seeing you through your bankruptcy from beginning to end.

From the moment you call us, you are treated in a respectful, non-judgemental manner. You will always meet with a federally-licensed insolvency trustee, not a junior administrator, who will be your personal liaison throughout the bankruptcy process, from filing through to discharge.

Call Us Today – 416-800-8756

Find out more about your debt elimination options, including personal bankruptcy or consumer proposal. While you’re on the phone, schedule your free consultation and let our federally-licensed professionals help you devise a plan to get out of debt today. At Ross Advisory Group, we won’t judge you, we’ll only help you eliminate your debt.