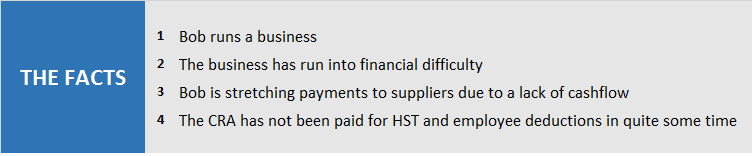

We often speak with people who have been billed personally by the CRA for tax debts owed by their corporations. The story usually goes something like this:

One day, a letter from the CRA shows up at Bob’s home. The letter indicates that Bob has been assessed personally for the HST and employee deductions owed by his business. Bob now personally owes the CRA all of the money that his business owes for the HST and employee deductions.

Bob is livid. How is it possible for the CRA to charge him personally for debt owed by his corporation? Bob recalls that one of the main benefits of incorporating was to protect himself from the business’s creditors to ensure that the debts of his corporation could not be charged to him personally.

Bob is right. In the ordinary course, a corporation’s creditors may not go after the owners personally. The CRA, however, is different. The CRA is empowered by laws which, in certain circumstances, allow it to collect. To understand the CRA’s power, it’s important to understand how monies become due to and are collected by the CRA.

The CRA collects money from people and businesses in many ways:

- Most people who are employed receive pay stubs outlining periodic deductions for income tax, Canada Pension Plan and Employment Insurance. After employers deduct these amounts from your paycheque, they must remit these employee deductions to the CRA.

- When you shop in Ontario, you pay HST on many of the most commonly used goods and services. Businesses that collect HST must then remit the net of these amounts to the CRA.

- Many other taxes and tariffs are collected by the CRA.

Suffice it to say, business owners who employ people and collect HST have obligations that most other people do not have. They must report their HST and employee deductions to the CRA in a type of tax return; they must also send the money collected to the CRA. Issues sometimes arise where business owners are not fully aware of these requirements. Other times, businesses (especially new businesses) do not generate enough cash to pay the CRA for the employee deductions and HST.

Over the short term, reporting and payment issues can often be corrected. If employee deductions or HST have not been reported, they can be reported late, though reporting late will often result in a late-filing penalty. If amounts are not paid, they certainly can be paid late, though interest will be tacked on to amounts owed. That’s why it’s always a good idea to remit returns and pay the CRA on time.

Over the longer term, late-payment penalties and interest can add up, and can cause a business serious financial difficulty. We sometimes see situations where the interest and penalties together add up to more than the amount of the actual HST, employee deductions or income tax owing.

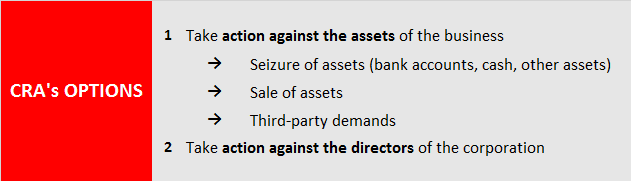

When corporations do not pay, the CRA has options:

Under the Excise Tax Act and Income Tax Act, federal laws which regulate the HST and parts of employee deductions, the CRA can (and often does) bill directors of a corporation amounts owed by the corporation for employee deductions and HST. The stated policy of the CRA is to first inform the directors that it is considering billing them personally. The idea is to allow directors to “respond to and explain all actions taken to ensure that the corporation deducted, withheld, remitted, or paid the amounts” that were due. If the director does not reply within a particular time period, the CRA may bill the director personally.

So, the question is, what should you do if you are a director of a corporation, and the CRA is now coming after you for debts owed by the corporation?

- You can always pay the government what it says you now owe it.

- You can dispute the amount by filing a defence. A defence can cost significant legal fees and will often not lead to a reduction in the amount that is owed, especially if you are the owner of the business and control its operations.

- You can eliminate the debt and stop the CRA in its tracks. Give us a call at 416-800-8756. Lets discuss your situation. We have tools to stop the CRA immediately.

Last year, we wrote about a client named Carlo who was faced with this exact same problem. Carlo was the director of two businesses and was billed personally by the CRA for source deductions and HST owing by the businesses. We helped Carlo eliminate the debt and get his life back.

If the CRA has billed you for your corporation’s liabilities or for any other tax matter, call us today at 416-800-8756. As we did for Carlo, let us help you devise a plan to eliminate your debt.